Tariff goalposts have shifted, but results remain the same

- 04.11.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The tariff goalposts have shifted, but the results remain the same

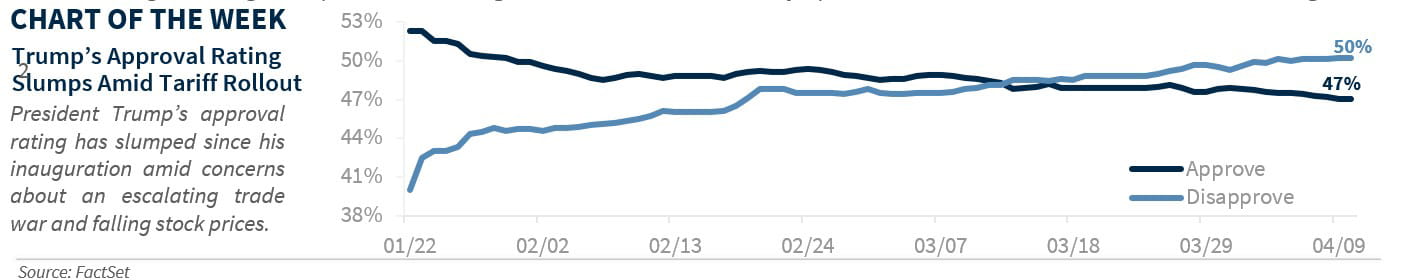

- Rising backlash and market turmoil force Trump to pivot on tariffs

- Uncertainty is likely to persist, but there are a few positives

Trump Recalibrates, Again. Investors have wondered for weeks if or when the 'Trump Put' would appear as stocks slumped amid an escalating trade war. Well, we finally got a glimpse at the answer this week. Whether it was falling stocks, concerning moves in the bond market or simple political calculus, the President’s decision to shift his trade strategy was a welcome sigh of relief (at least temporarily). But once the dust settled and reality set in, the outcome barely changed. While country-specific tariff rates shifted based on the president’s new trade strategy, the weighted average effective tariff rate remained at historically elevated levels – up notably from the 2.5% level that existed before Trump began his second term. Below we discuss the latest developments in the trade war, provide our take on why President Trump pivoted, and the market’s reaction to the news.

- The tariff goalposts keep changing | In a not-so-shocking turn of events this week, President Trump announced a 90-day pause on the 'higher' reciprocal tariffs, opting instead for a 10% universal tariff on all countries except China, which saw its tariff rate increased to 145%. The 25% sectoral tariffs on autos, aluminum, and steel remain unchanged. While this temporary pause on the 'higher' tariffs allows more time for countries to negotiate trade deals, the increased tariff on China—which accounts for ~14% of all US imports—means the weighted average effective tariff rate remains at our previous estimate of around 22.5%. In another tit-for-tat, China retaliated, lifting its tariffs on US goods to 125%, with no further escalations planned. The key point: Although the goalposts have shifted, the revised tariff rates (assuming they proceed as planned) still pose significant headwinds to growth and increase the risk of higher inflation in the coming months.

- Three reasons for Trump’s pivot | President Trump's tariff reversal followed sustained pushback from business leaders and politicians, after a significant equity market downturn and bleak recession warnings from many Wall Street economists.

- Criticism from business leaders – It appears that President Trump’s support from the business community has waned since the roll out of the tariff plan. With an ambitious agenda still planned (e.g., tax cuts, deregulation), mounting criticism from business executives suggesting that uncertainty was negatively impacting their hiring and business decisions, may have played a role.

- Market dislocations – In addition to the ~20% decline in the S&P 500, concerning moves in the bond market caught the administration by surprise. Credit spreads widened sharply as investors priced in rising recession odds. The increased volatility has led to delays in new issuance, with Treasuries—considered the bedrock of the global financial system—showing signs of strain. Yields shot higher despite pressure on equity markets, raising questions about the US Treasury's safe-haven status and suggesting a potential loss of confidence.

- Political pushback – The sweeping tariffs and aggressive trade strategy were facing pushback from Trump's staunchest Republican supporters. Several Republican senators openly urged the president to accept some trade deals and tone down the rhetoric. Meanwhile, some House Republicans seemed open to legislation that would challenge the president's authority under the International Emergency Economic Powers Act (IEEPA). Clearly, Trump will need to maintain his party's support for other priorities, such as tax cuts.

- Why did the market initially rally? | The S&P 500 sharply rebounded following the policy u-turn, climbing 9.5%—its best one-day gain since 2008. With the market experiencing its third worst 2-day decline (-10.5%) in 30 years, deeply oversold conditions (14-day RSI ~20) suggested a technical bounce was likely. But while the overall effective tariff rate did not move lower, the policy pivot had a few potential positives:

- There is now some semblance of a plan in place – Trump's willingness to negotiate is welcome news, especially after his initial stance of "tariff permanence" and "non-negotiable" terms. The administration's unconventional reciprocal tariff rate formula led to surprisingly high tariffs. Any momentum toward 'making a deal' and de-escalating tensions would help reduce some of the uncertainty.

- Treasury Secretary Bessent assumes lead role – While trade hardliners Peter Navarro and Howard Lutnick were prominent during the initial tariff rollout, the apparent shift to Treasury Secretary Bessent leading the negotiations suggests a new ‘softer’ approach. Bessent's extensive financial market experience, understanding of trade dynamics, and more moderate stance should reassure the market.

- Coordinated effort to confront China – The original tariff rollout forced the US to manage disputes with every trading partner simultaneously. The 90-day delay will give the administration time to reach agreements with key allies (e.g., Mexico, Canada, Japan, India, and Europe) and confront China as a united front. This collective approach should facilitate negotiations with China and eventually reduce the 145% tariff rate, thereby significantly lowering the overall trade-weighted effective tariff rate.

Bottom line | While President Trump's 90-day delay is a meaningful shift, we are not adjusting our already lowered 2025 forecasts (GDP at ~1% and S&P 500 target of 5,800). With the weighted average effective tariff rate expected to stay around 22.5% temporarily (but fall significantly by year end), the economy will still face substantial headwinds. Even though the worst-case scenario (an outright trade war with our major trading partners) appears off the table, the risk of a recession remains elevated. As the first quarter earnings season begins today, we will closely monitor for signs of margin compression or slowing demand, which could further jeopardize our current $250-$255 S&P 500 2025 EPS target.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.