How have markets and the economy performed in 2024?

- 03.22.24

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- U.S. economic growth is still on solid ground

- Bonds give back some of last year’s gains

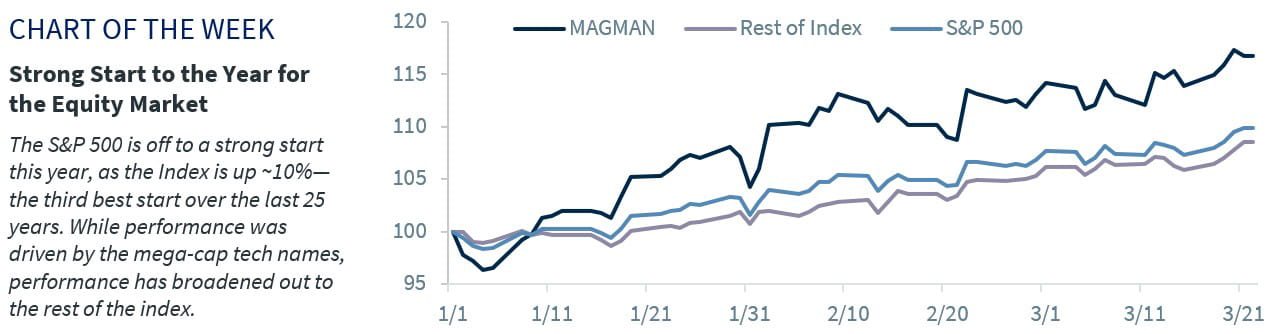

- Equity markets are off to best start since 2019

Happy National Cleaning Week! Who knew there was a week dedicated to celebrating the annual tradition of spring cleaning? Makes sense when you think about it given spring is a perfect time of year to clean, clear out the clutter, reorganize your home, and get your yard in top shape. After the winter, there is certainly no shortage of things to do around the house or areas that need a little refreshing! And just like we meticulously go room to room during the springtime, we use that same lens to review the economy and the financial markets. Below we take stock of how the economy and markets have performed since the beginning of the year and take a fresh look at where we are heading as we progress through the year.

- Economic growth still on solid ground | The U.S. economy remains on solid footing, although the pace of growth is expected to downshift to 2.1% in 1Q23 according to the Atlanta Fed’s GDPNow estimates, sharply lower than the 4.9% annualized pace the economy recorded in 3Q23. Growth has been supported by strong job gains (payrolls averaged 229k over the last year), improving housing activity metrics and a resilient consumer (thanks to rising real incomes). While consumer spending is growing at a solid clip, cracks are forming. For example, while consumers have increasingly turned to credit to maintain their spending, serious delinquency rates on credit cards are on the rise and borrowing rates have become onerous for lower-income households. These cracks have not been widespread enough to push the economy off course but should act as a drag on consumption going forward, particularly if the labor market starts to weaken. We modestly increase our 2024 GDP forecast from 1.7% to 2.1%. Hot inflation prints have delayed, but not derailed prospects for Fed rate cuts (policymakers are still penciling in three rate cuts in 2024), which aligns with our view of three rate cuts by year end.

- Bonds give back some of last year’s gains | The 10-year Treasury yield has climbed ~35bps since the start of the year, erasing some of the 100+ bps decline in the final months of 2023. Strong labor market data, hotter than expected inflation and reduced expectations for Fed rate cuts in 2024 have been the key drivers of the upward move. Supply pressures have taken a back seat as a key factor driving Treasury yields as demand has remained healthy. The biggest story in the fixed income markets during the quarter has been the deluge of investment grade corporate bond issuance, with over $500 billion in new bond sales this year – the highest volume of sales on record since the start of the year. Despite the heavy issuance, soft-landing optimism, and improving earnings outlooks, attractive yields have led to increased demand for corporate credit, driving corporate bond spreads to record tight levels (Inv. Grade: 88, High Yield: 292 and Emerging Markets: 264 bps). While yields have climbed to start the year, the combination of slower growth, moderating inflation and a Fed easing cycle should drive yields lower by year end.

- Equity markets set new highs | The S&P 500 is off its best start to the year since 2019, climbing ~10% and hitting its 20th record high YTD. While mega-cap tech related names (or MAGMAN – MSFT, APPL, GOOGL, META, AMZN, NVDA) are up ~17% YTD on the back of AI euphoria and stronger earnings trends,* performance is broadening with the rest of the S&P 500 up ~9%, with 10 of 11 sectors in positive territory. Resilient economic data, strong earnings (2024 earnings have bucked the typical downward revision trend), AI optimism and increased investor optimism have been the key drivers. Historically, a strong start has been a positive signal for the market, with the S&P 500 up an additional ~7% on average the rest of year when Q1 performance is greater than 10%. While we remain optimistic longer term, caution is warranted in the near term. Why? First, a lot of good news has been priced into the market. Case in point: the S&P 500’s last 12-month P/E is trading at 23x for the first time since 2000 – something that has only happened 5% of the time over the last 20 years, leaving the market vulnerable to any potential earnings/economic misses. Second, investor complacency is setting in – the % of bullish investors is at elevated levels and Wall Street strategists are racing to increase their targets. Third, the market is due for a pullback. Historically, the S&P 500 averages three to four 5% or more pullbacks each year, with an average max drawdown of 13% and the last 5%+ pullback was in October 2023.

- Commodities get a boost | The resilience of the U.S. economy, particularly relative to its DM counterparts, has boosted the dollar year-to-date. The dollar is up ~2%, with notable moves vs. the yen as the currency pair rose to the highest level (151) since 1990. Despite the strength in the dollar and weak growth overseas, commodity prices generally climbed during the quarter. This is unusual as the dollar is typically negatively correlated to commodity prices. Crude oil rose back above $80/bbl for the first time in four months on elevated geopolitical risks and potential supply disruptions. Going forward, we expect record US production to keep oil prices contained around $85/bbl. Gold also saw notable moves, rising above $2,200/oz for the first time on record.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.